Commonwealth Credit Cards

Credit cards - CommBank

CommBank Essentials credit card 9.90% p.a. purchase interest rate $2 monthly fee when you choose online statements and set up automatic repayments from a CommBank transaction account using AutoPay. Otherwise monthly fee is $5 4 Credit limit from $400 to a maximum of $3000 Tell me more Low fee credit cards

https://www.commbank.com.au/credit-cards.htmlCredit Cards | KY Credit Union Visa Rewards | Commonwealth CU

The Commonwealth Credit Union MY Card slashes your interest charges with a low introductory rate. It also helps you earn attractive rewards in a hurry by paying 3 points per $1 spent on transportation and travel and 1.5 points for all other purchases. Step 1: Use MY Card for your everyday purchases & earn Everyday Rewards

https://www.ccuky.org/my-life/borrow/credit-cards

Credit & Debit Cards | Commonwealth Bank

Credit & Debit Cards Credit & Debit Cards Enjoy the convenience of our suite of credit & debit card products. Your lifestyle, interests, and needs are unique. We want you to have the credit card that best suits your life. Discover the extraordinary benefits of Commonwealth Bank’s suite of debit and credit cards. 24-hour customer service

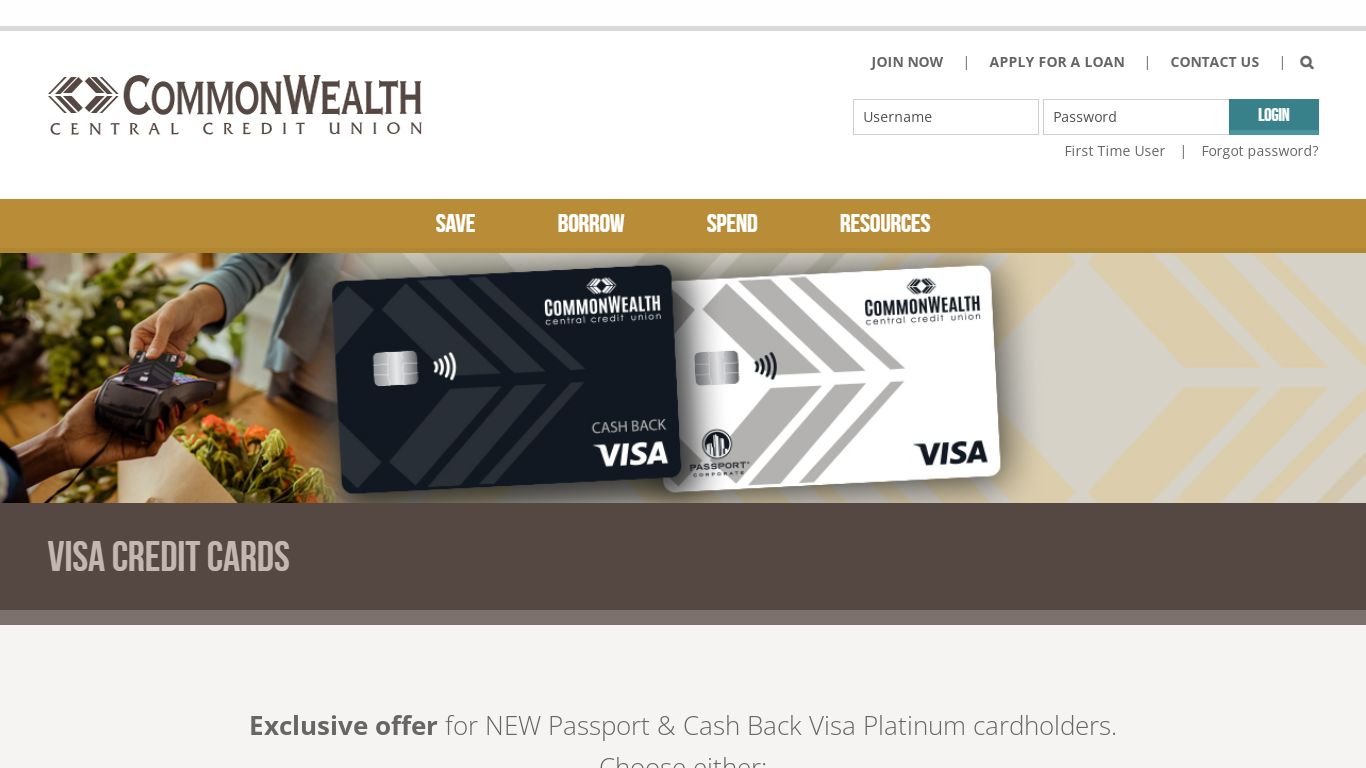

http://www.combankltd.com/credit-cards/Credit Cards | CommonWealth Central Credit Union

Rates as low as 12.15% APR*. Credit limits: $500 - $50,000. All other CommonWealth Visa credit card features. Exclusive offer for NEW Passport Visa Platinum cardholders. You can choose from one of the following offers: An introductory rate of 0% APR* on balance transfers for 12 months¹.

https://www.wealthcu.org/credit-cards

Credit card offers - CommBank

Low Rate credit card Enjoy the flexibility of 0% p.a. on purchases for 18 months + $100 cashback Apply for a new Low Rate credit card and spend $1,000 on purchases within 90 days of card activation. ~ Limited offer Expires 31/10/22 At a glance 13.24% p.a. purchase interest rate $59 annual fee Minimum credit limit $500 Trade-offs

https://www.commbank.com.au/credit-cards/credit-cards-offers.htmlCredit Cards › Commonwealth Credit Union - ccuky.org

Earn 1.5 Points for every $1 you spend on purchases Your points balance is available through Online Banking, our Mobile Banking App, or by contacting Rewards at 855.228.4793. Cash Back Our Summit card offers a cash back option so you can turn your points into cash! New Cardholder Perks 0% intro rate for 6 months from account opening on Purchases.

https://www.ccuky.org/my-business/expand/credit-cards

Mastercard | Commonwealth Bank

Your CB Mastercard will provide you great security and convenience when traveling for business or pleasure, paying for professional services, conducting business, dining out or shopping. Benefits of Mastercard: Accepted at over 39 million global locations — in The Bahamas and around the world 1% cash back on annual purchases (Mastercard Gold only)

http://www.combankltd.com/credit-cards/mastercard/

Apply For A Personal Credit Card | First Commonwealth Bank

If you lose your credit card, immediately notify us at 800-711-BANK (2265). Contact Us Today to Apply for a Credit Card Online. It’s time to take control of your finances. Whether you want a credit card with cashback rewards or a business credit card, you can find the solution you need from First Commonwealth Bank.

https://www.fcbanking.com/personal/credit-cards/

Choose Your Path › Commonwealth Credit Union

Path! Welcome to Commonwealth Credit Union. To start your financial journey, click on one of the options below to learn more about our products, services, and how We CU Differently®! Or, if you'd like to join our team, view our open positions. It's a big world out there, especially for students. Let us focus on you and your financial journey!

https://www.ccuky.org/

Home | CommonWealth Central Credit Union

CommonWealth offers a full range of financial services in Santa Clara like free checking accounts, VISA credit cards, competitive loan rates, and mobile banking.

https://www.wealthcu.org/

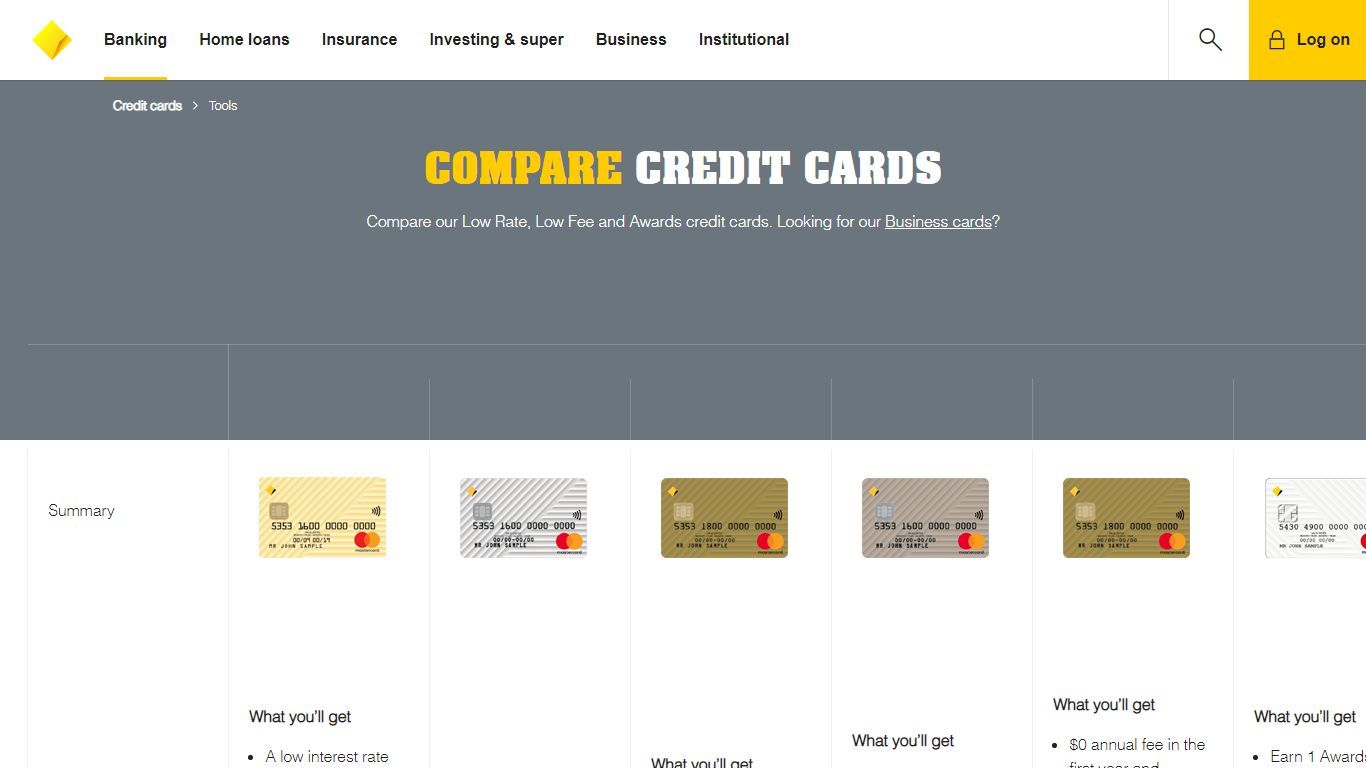

Compare credit cards - credit card comparison - CommBank

Standard fees and charges for credit card services 1 The annual fee is charged at $5 per month or $2 per month if you: • Set up automated monthly repayments through our credit card AutoPay from a CommBank transaction account and

https://www.commbank.com.au/credit-cards/tools/credit-card-compare.html